The LIBOR Financial

We are a periodic newsletter written by a team of select LIBOR members focused on covering recent global macro events, the equity, fixed income, commodity, and currency markets, as well as recent M&A and IPO deals. The newsletter also caters to alumni on the Street with special updates on LIBOR events and speakers. Overall, the goal is to provide a platform for writers to develop opinions on meaningful trends in the financial markets and keep up to date with the latest news.

Heli Sheth | Editor-in-Chief

VOLUME ARCHIVE

2022-2023

Editor-in-Chief: Matt Rossi

Assistant Editors: Sean Li and Heli Sheth

Columnists: Evan Yerman, Rishitha Annamaneni, Vijay Talluri, Neha Thakur, Lukian Wernyj, Teddy Kesoglou, Muneeba Tariq, Kevin Ruple, Ryan Rybka, Tara Chilton, Mahek Shah, Zach Friedman, Kinzaa Anis, Pranav Kalambele, Aryan Patel, Sahana Harikrishnan, Hugo Tan, Derin Kalay, Cameron Egan

Healthcare M&A Soars and Debt Ceiling Debates Continue

Welcome to the first issue of the LIBOR Financial for the Spring semester. We have all been working diligently over the past week to report on interesting and impactful events across financial markets, with special focus given to rising energy prices, US debt ceiling negotiations, and significant M&A activity in the healthcare space.

Tightening Fears & the New BOJ

Welcome to the second issue of the LIBOR Financial for the semester. We have all been working diligently over the past week to report on interesting and impactful events across financial markets, with special focus given to the global economy following the new regime at the helm of the BOJ, and fears of further tightening in the U.S. following new macroeconomic data.

2021-2022

Editor-in-Chief: Jane-Marie Lai

Assistant Editors: Matt Rossi and Alan Gutman

Columnists: Adam Giovanelli, Chidinma Chigozie-Nwosu, Rishitha Annamaneni, Vijay Talluri, Muneeba Tariq, Aryan Kumar, Miguel Rizarri, Brian Zhong, Armen Panossian, Sia Mukhi, Joseph Cobo, Andrew Zhong, Ronak Walia, Evan Yerman, Heli Sheth, Sean Li, Robert Krasowski (Fall), Michelle He (Fall), Krishna Bliss (Fall), Yeying Pan (Fall), Sahana Harikrishnan (Spring), Amulya Natchukuri (Spring), Rohan Dash (Spring) Jasmine Khosla (Spring)

It’s Back to School Season

Welcome to our first edition of the LIBOR Financial for the new academic year! We have incorporated several new changes to the newsletter, including aesthetic visual alterations and an alumni spotlight segment. We also have a nice surprise for you at the end to formally get to know the incredible team behind LIBOR.

The Fed Tapers

Welcome to our second edition of the LIBOR Financial! In this issue, we'll hear all about the Fed's tapering plan, the state of ransomware, labor shortages and more. Our alumni spotlight this week is Simmi Sharma, and if you read all the way, you'll find a nice surprise where you'll get to know a member of the LIBOR team better!

Corporations Face Halloween Chills

Happy spooky season to you! As we students zombie walk into Halloween week, several global corporations and countries face their own spooky challenges too... namely lawsuits, sky-high inflation, and geopolitical conflicts. In this issue, we'll dive into these issues while getting to know Evercore's Eric Lang, and our very own LIBOR Vice President, Shree Raghavan!

It’s Getting Meta Here

Hope you all had a wonderful Halloweekend! In this issue we discuss the impacts of Facebook's rebranding from a technology and healthcare perspective, analyze the continued issues surrounding international inflation, and dive into supply chain issues permeating Asia. We are also excited to feature Société Générale's Jeanne Fitzpatrick, and hope you take the opportunity to read all the way to the end to meet LIBOR's Treasurer, Nihal Dhruva!

Time for Infrastructure

We hope everyone has been adjusting well to Daylight Savings Time! In this issue, we spotlight Alumni Brian Neer from Morgan Stanley and our very own SMF co-director Devin Kusmider. We'll also breakdown Biden's infrastructure bill, discuss Coke's most recent acquisition, and dig into COP26 Climate Conference.

Company Break Ups

The past week has been filled with immense discussions of global trade deals, acquisitions across multiple industries, and talks of green energy; join us as we explore each of these issues in our columns below. We're also excited to introduce Monica Sung in this week's Alumni Spotlight segment and Rayhan Murad in our Meet the LIBOR team section at the end of the newsletter.

The Oil Question

Happy first day of Thanksgiving Break! We hope you're taking the time to unwind and indulge in some turkey (and leftovers) in the next few days. In this issue, we'll dive into the on-going energy issue, discuss inflation, and much more! We're also excited to spotlight Blackrock's Ty-Lynn Johnson and LIBOR's Director of Marketing Avig Pointi.

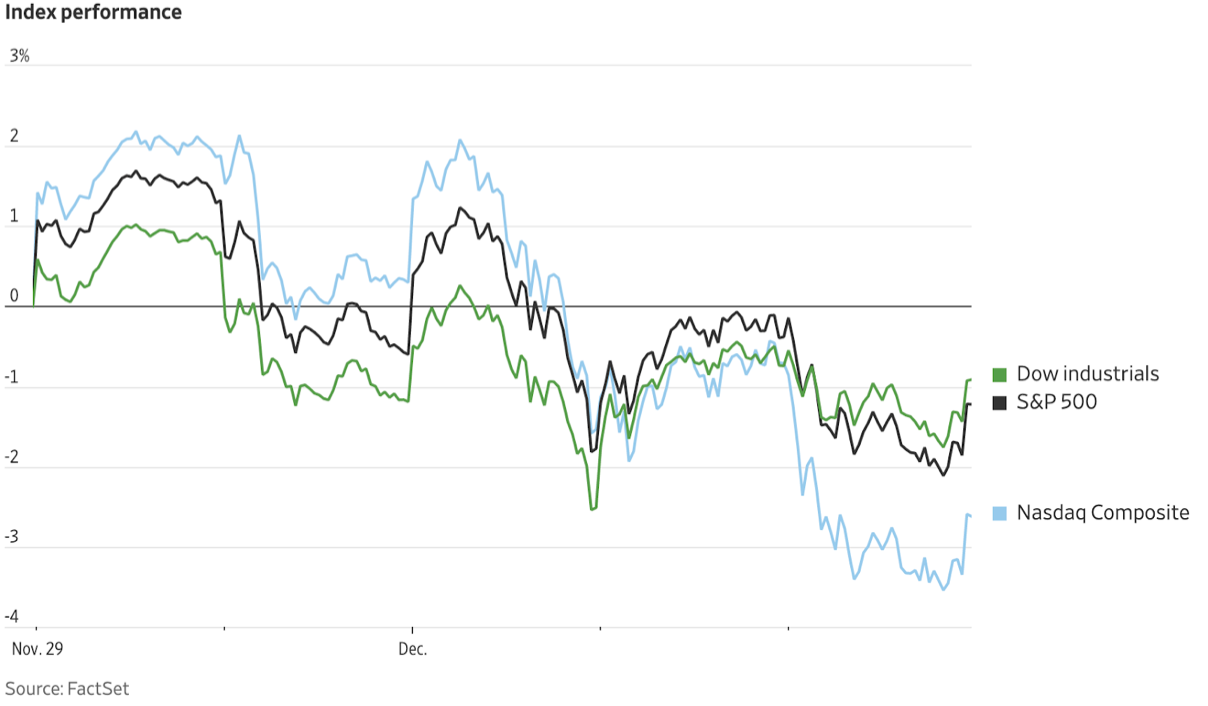

Omicron

Welcome to our final edition of the year! With projects and finals approaching, we're almost in the endgame. This issue, the LIBOR Financial is excited to present a UBS alumni and showcase our Co-Director of Alumni Relations. We'll also dive into Turkish Lira, look at changes developing in Big Tech, and explore implications of the Omicron variant.

The CPI

The recurring issue is the Consumer Price Index (CPI) but we will also discuss the FDA for COVID-19 Vaccines, dive into 5G, and look at earnings from several companies.

Airline Mergers and More

This week, markets have been volatile with Russia and the state of the pandemic as the key drivers. We'll dive into the inflationary environment, the highly anticipated airline merger, and more.

The Ukraine-Russia Situation

We're excited to introduce Isaac Walkin from Hildene Capital Management in our Alumni Spotlight and showcase Shreya Sharma, our Co-Director of External Relations. This week's hot topic is all about the uncertainty, speculation, and impacts surrounding the Ukraine-Russia Situation. Read onwards to see how our columnists tackle these issues and other emerging new topics.

The Invasion Continues

We hope your midterms have been going well. In this issue, we're taking another look into the Russian invasion of Ukraine and the various ripple effects on different markets and economies. In other words, we are excited to spotlight our Alumni Abdalla Al Fahham from Disney and showcase Sejal Rajagopalan, our Co-Director of Alumni Relations.

A Chaotic New Normal

Welcome to a new issue of the LIBOR Financial and hope midterms are going well! In this issue, we'll be spotlighting Carolina Reis from Goldman Sach's Compliance team and showcasing the last member of our LIBOR Team, Kriish Parekh. Aside from new updates on how Russia's invasion of Ukraine has been impacting the market, we'll also cover new topics like Tesla's new gigafactory, an antitrust lawsuit, and more!

Electric Technology

Welcome to our fourteenth edition of the LIBOR Financial. In this issue, we're excited to spotlight Ryan Zinsky, an Investment Associate in Vestar Capital Partners! We'll also discuss the continued impacts for the Russia-Ukraine War including supplying chain issues, rising gas prices, and more.

The Fourth Dose

Welcome to a new issue of the LIBOR Financial! In this issue, we're proud to spotlight Esha Tripathi from Morgan Stanley and hear her talk about her experiences in International Equities Sales. We'll also cover concerns on the inverting yield curve, look into Sri Lank's economic crisis, discuss the Russia-Ukraine war-induced neon shortage, and more!

Europe's Making Moves

Welcome to our sixteenth edition of the LIBOR Financial for the new academic year! We're proud to spotlight Patrick Natale, Head of Equities Morgan Stanely Wealth Management. In this issue, we'll continue to look at how the Russian-Ukraine War takes a toll on the markets, take a deep dive into issues in the Healthcare industry, interesting consumer trends, and more!

Tweet This

Welcome to the second to last issue of the semester! In this issue, we're excited to spotlight Emanuel Marques from Goldman Sachs and hear about his current role. We'll also discuss the much-debated Elon bid for Twitter, news from investment bank giants, stir-ups in the retail industry, and more!

It’s a Wrap

Welcome to our last edition of the LIBOR Financial! It has been eighteen issues, and the writers, assistant editors, and I are proud to have delivered a diverse series of market news and opinion pieces this past year. For our last issue, we're proud to spotlight alumni and head of the RTWS program, Ken Freeman. We'll also talk about Netflix's subscription issues, some currency intervention, semiconductor production, and more!

2020-2021

Editor-in-Chief: Michelle He

Columnists: Adam Giovanelli, Rishita Annamaneni, Heli Sheth, Jane-Marie Lai, Matt Rossi, Brian Zhong, Riddhi Patel, Armen Panossian, Muneeba Tariq, Andrew Zhong, Vijay Talluri, Chase Smith, Ronak Walia, Jawad Shafiq, Odhran King, Alan Gutman, Sean Li, Julia Laszcz, Evan Schlatter

Welcome back to our first issue for the academic year of the LIBOR Financial! This year we have incorporated several new changes to the newsletter, including a weekly recap, several additional industry sections, and an archive on the website for all of our issues. Thank you for joining us and please be on the lookout for upcoming LIBOR events. Stay safe everyone!

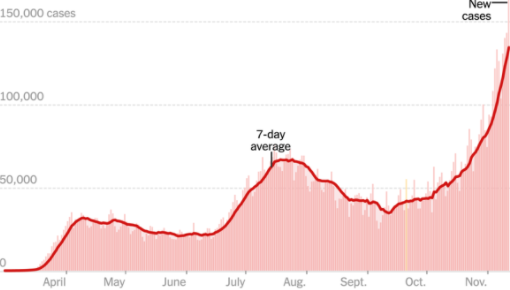

In this issue, we cover the financial impacts of some major releases, like the PS5 and Disney earnings report. Other major events, like news of a possible Covid-19 vaccine, have moved the financial markets and will be covered here. Thank you for joining us, and please be on the lookout for upcoming LIBOR events. Stay safe everyone!

In this issue, we cover updates on COVID-19 vaccines, Amazon's move into the pharmacy business, and much more. Thank you for joining us and please be on the lookout for upcoming LIBOR events. Hope everyone enjoys their Thanksgiving break!

Welcome back to our fourth issue of the academic year, we hope that everyone had a great Thanksgiving! In this issue, we'll cover the financial impacts of major events such as Black Friday and the announcement of AstraZeneca's vaccine for Covid-19. We'll also take a look at how some industries (oil, looking at you) are riding high on hopes of a vaccine changing the new normal back to, well, the old normal.

Welcome back to the LIBOR Financial and our final edition for the semester! This week, our team takes a look at both domestic and global economies, a shortage of Christmas trees, the acquisition of Slack, and a whole lot more. Best of luck on finals and happy holidays!

The past few weeks have been packed with events that will go down in history, such as Biden's inauguration, the riot in Washington, DC, and the surge in Gamestop's stock due to r/WallStreetBets. Today, we'll be talking about the financial implications of these events, and the bigger picture of it all.

This week, our team takes a look at some of the first economic indicators of the year, upcoming mergers in the food delivery space, and *hopefully,* the end of the GameStop drama. If you have missed any of the editions this year, feel free to check them out on our website archive.

This past week has been action-packed, but honestly, what week in the last year hasn't been "unprecedented"? Today we'll be discussing events such as Nestle's spinoff of its bottled water brands, competitors being added to the "chicken sandwich war", and China contemplating its future with coal as its supply shrinks.

We thank everyone here for diverting his/her attention away from midterm preparations long enough to read this issue. Today, we'll be covering topics including Texas' deep freeze, Walmart's wage hike, and Zambia's default on its loans. Have a great week and good luck to everyone taking midterms!

Last week had big developments in Washington and the pharma industry. The rejection of the $15/hour minimum wage and approval of a new Covid-19 vaccine will doubtlessly impact the recovery of the economy in the near future. Today, we'll be talking about the financial implications of these events, and the bigger picture of it all. Have a great week and stay safe, everyone!

This week, our team takes a look at topics like the spike in oil prices, the changes in public health policies, and the highly anticipated interview with the Chairman of the Fed, Jerome Powell. If you have missed any of the editions this year, feel free to check them out on our website archive. Have a great week, everyone!

Welcome back from spring break, we hope that everyone had a relaxing week. Over the last two weeks, there have been major developments in vaccine approvals, highly anticipated announcements from the Fed, and much more. We'll review all of that in this week's edition of the Financial. Have a great week and stay safe, everyone!

This week, we take a look at some market-moving events including the traffic jam in the Suez Canal, global chip shortage, and continued vaccine rollout. If you have missed any of the editions this year, feel free to check them out on our website archive. Have a great week, everyone!

Welcome to the 14th edition of the Libor Financial! Thank you for taking the time out of a week crammed with midterms to read our recap of a very eventful week. In this issue, we give you our take on the financial implications of events from the Evergreen getting freed to the rosy March jobs report.